"The United States and China have a long history of economic rivalry. But since the end of 2017, the Trump administration started to challenge China’s business activities. The U.S. began setting tariffs and other trade barriers on China to force it to make changes to what the U.S. says are unfair trade practices and intellectual property theft. All these actions have spiraled into a full-blown economic and trade war.

Though the trade war reached its end on January 15, 2020, where the two sides reached a phase one agreement, tensions between the United States and China persists and is negatively impacting not just these two countries but many others..."

Since the paper introduces interrupted time series (ITS) analysis as a practical method for event impact evaluation, we propose to study if we can apply ITS analysis to a different scenario:

The China-United States Trade War

How we achieved

To do so, we collect several different types of datasets (e.g., U.S. Trade in Goods with China, US foreign trade with product details) from WTO, OECD, the United States and China’s official website. (You can access our data source by clicking the pictures below)

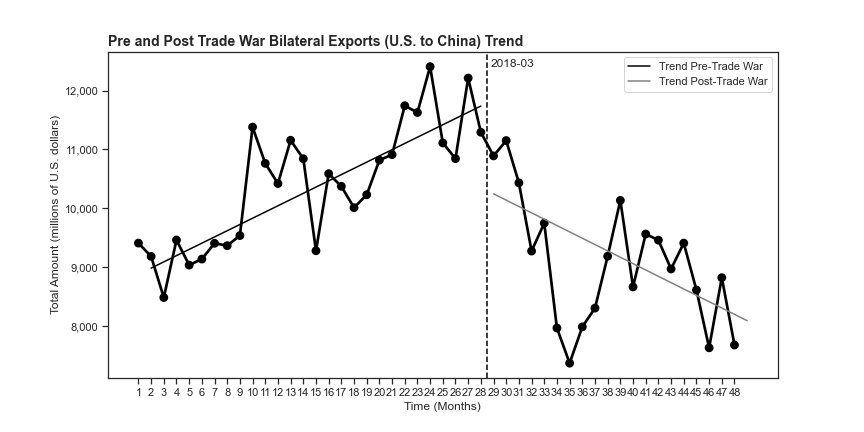

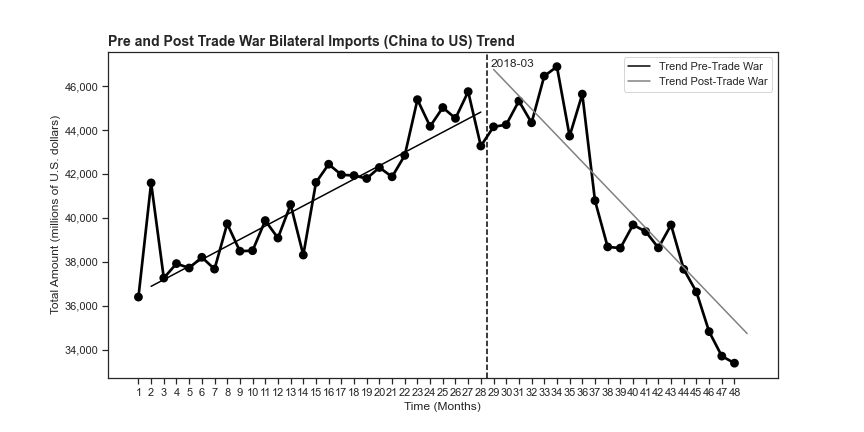

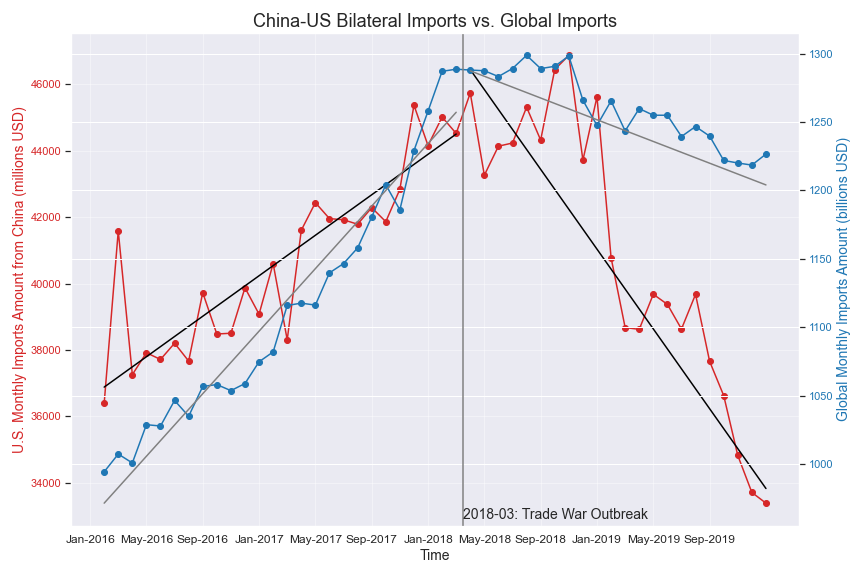

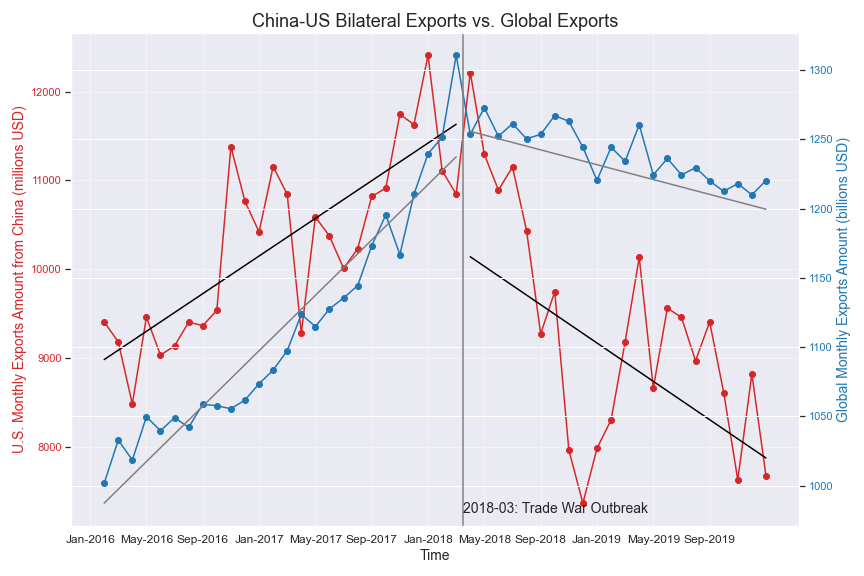

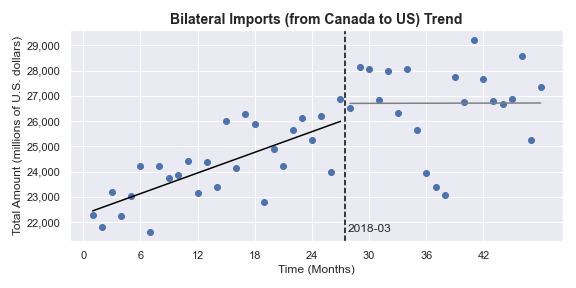

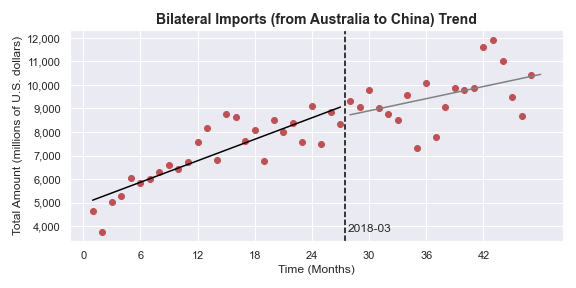

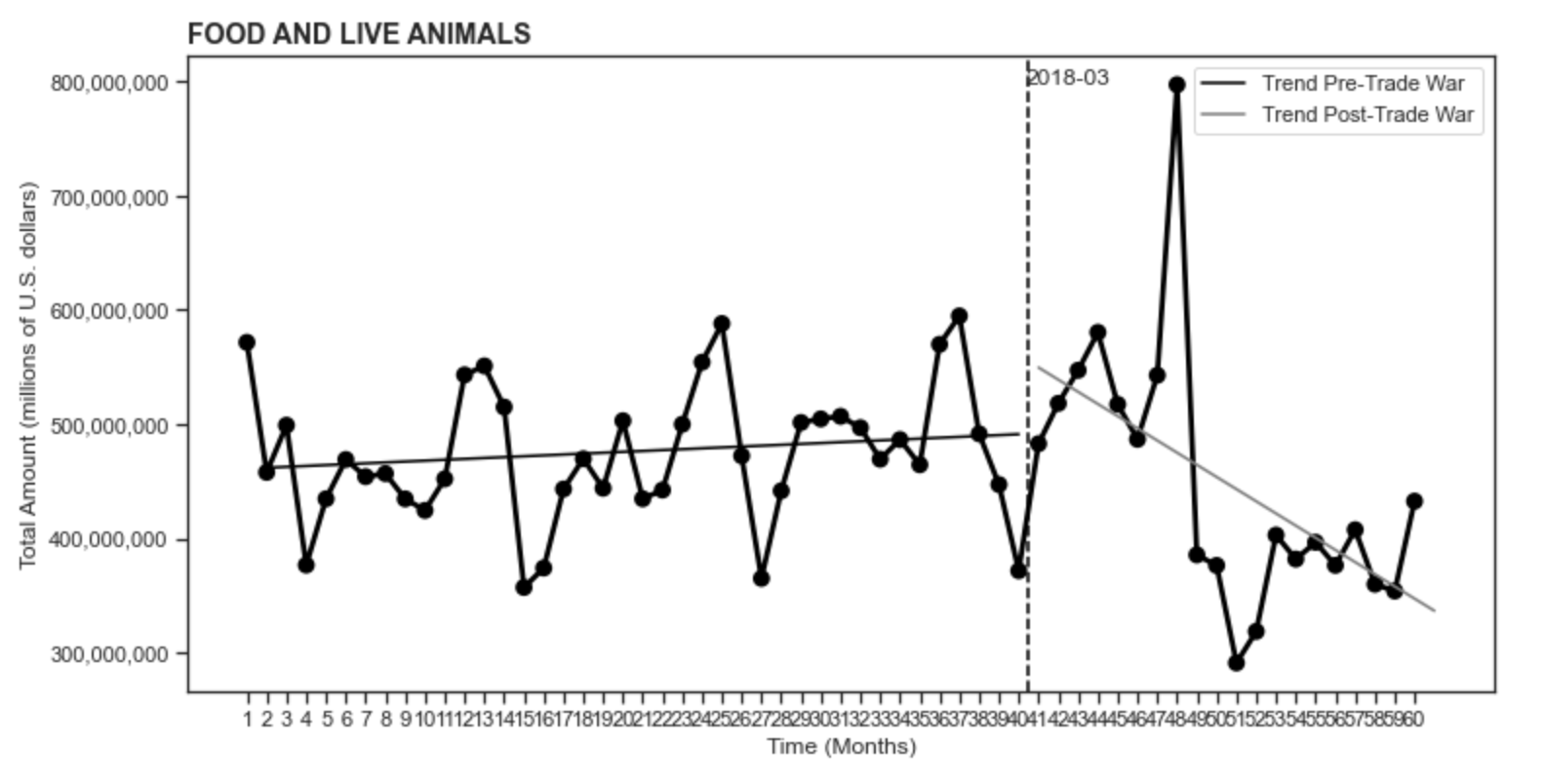

We then use ITS analysis on these datasets and see if there exists a significant impact on the China-US trade. Given that the U.S. took actions to apply tariffs on Chinese goods on March 2018 for the first time, we chose it as the trade war event intervention in our analysis. Moreover, we try to extend the ITS analysis method to better interpret multiple objects of study and other factors, including different business partners, industries, and seasonality effect. The visualization of analysis will allow us to understand the economic outcomes easily.

Our Goal

Our main goal is to find out How does the trade war affect the bilateral trade (i.e., exports, imports) between China and the US?

we are also interested in investigating further into other aspects of the trade war:

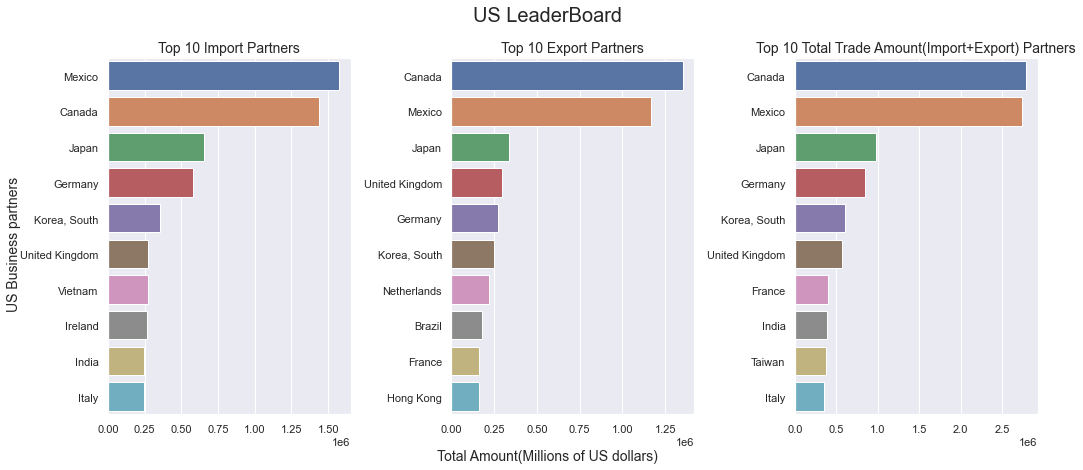

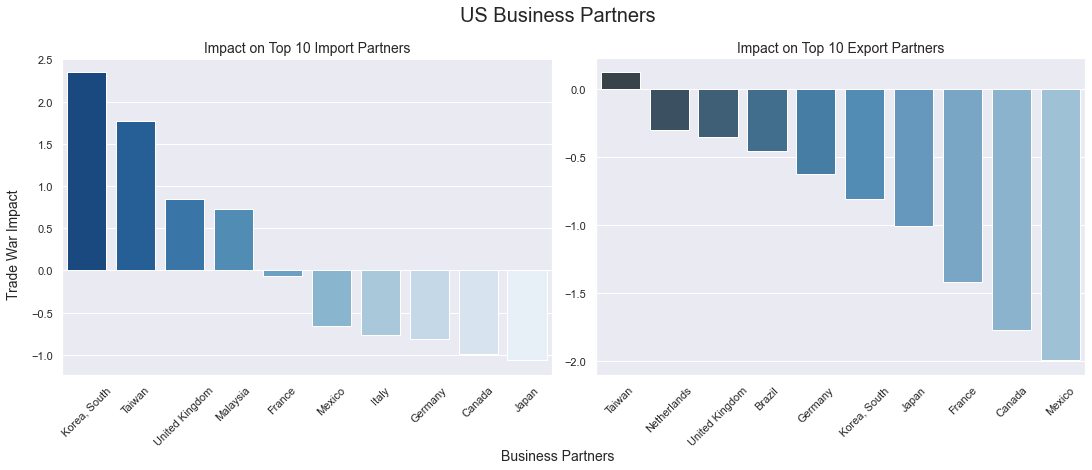

- The resulting change in the trade of their business partners such as the European Union

- Different levels of impacts in various industries

All these results would provide us with a broader and deeper understanding of the impacts of the trade war, and we would try to interpret them from different perspectives.